Paying taxes is no fun

Paying taxes double and tripple is even less fun.

Because let’s face it: when buying a pair of NEW shoes in Germany the average German Joe already pays at least 19% MwSt. plus the income tax of the company.

When selling those shoes second hand the German state now wants – again – taxes.

Taxes are of course important as it is THE biggest governmental control mechanism to steer the economy (tax the evil more and the good less) and curb excesses and redistribute wealth (the last functionality is mostly (thanks to Panama) dysfunctional, but there are even more functions).

Buying as much second hand as possible, refurbish + re-use + repair is a good thing (except for devices with tiny batteries that are hard to replace and sometimes hard to get cleaned in an hygienic way such as earbuds) as it saves massively on the planet’s resources.

As reported by “Der Stern” (the star) in 2023-01: The German tax department set an randomly chosen upper limit (?) of tax free selling of (mostly) second hand goods to max 29 trades per year or total of 2000EUR per year for example on eBay.

highly recommended read: when is a sale “professional” (tax) or “private” (no tax): https://www.test.de/Privatverkauf-und-Steuern-Wann-das-Finanzamt-bei-Ebay-Verkaeufern-nachhakt-4802200-0/

What this means?

This will result in less selling of second hand goods, as users will either completely stop selling, for fear of getting entangled with the German tax department madness or will closely monitor their sellings and stop right before the limit.

This was (probably) not what the law-maker intended, but this is how this decision will play out. (so the gov just steered Germany in the wrong direction, away from sustainability and reuse and towards “do nothing” or “trash it” (seriously: most 50+ will just trash their old stuff)

“congratulations” all involved

Please increase upper limit 10x fold to 290 trades per year and 20.000EUR tax-free yearly activity or watch the economy die (as users will prefer “do nothing” (bad for the already struggling economy) or decide to resort to the well-known “flohmarkt” (boot sale) offline selling (a good idea) or even worse trash their second hand stuff (a very bad idea)).

“Operators of digital platforms (Ebay, Ebay-Kleinanzeigen, Vinted, Mobile.de and others) will be required to report information to the tax authorities on income generated by providers on these platforms. In order to also cover foreign providers, there will be an automatic exchange of information between the member states of the European Union.” (auto translated from bundestag.de)

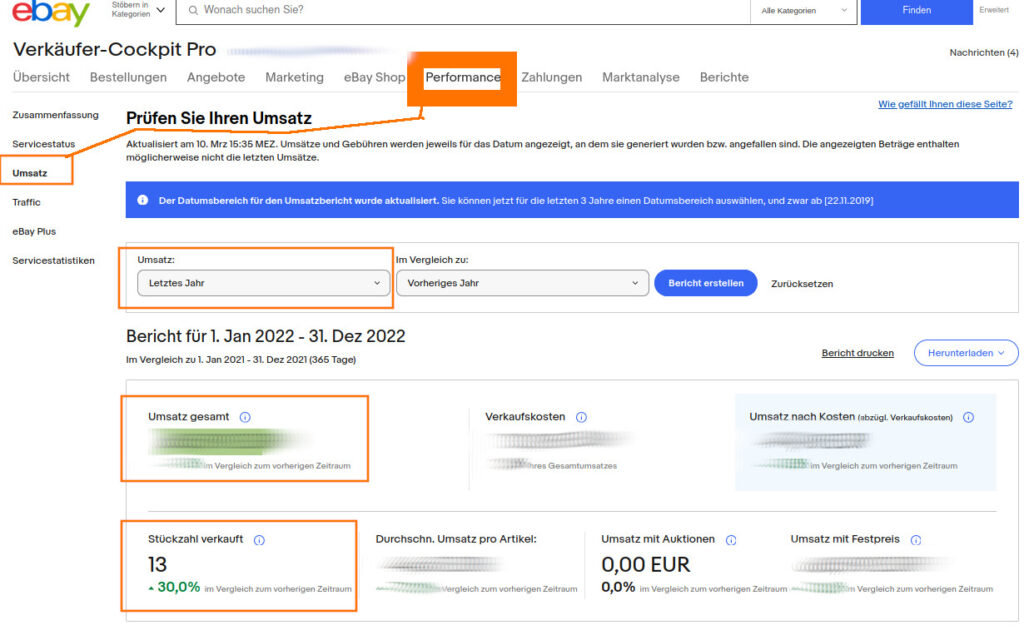

how to where to view yearly eBay turnoever – jährlichen gesamt Umsatz und Anzahl Verkäufe einsehen Übersicht

or try hitting this link: https://www.ebay.de/sh/performance/sales?referencePeriodFilter=LAST_YEAR&benchmarkPeriodFilter=PRIOR_YEAR

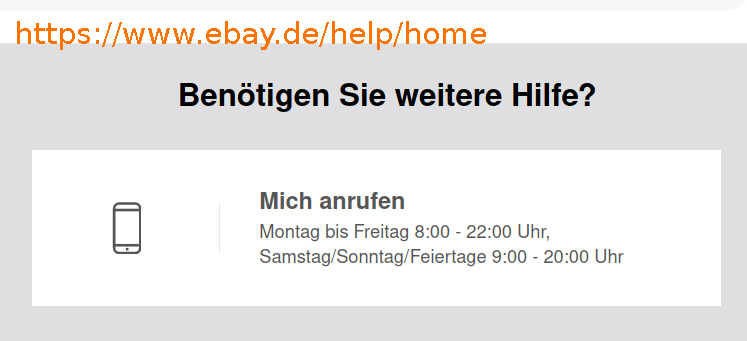

had to use the “eBay CallMeBack customer support service”, find the above in it’s now even more complicated eBay “selling cockpit” (this allone is a reason for many privateers 50+ to completely avoid eBay alltogether: too complicated)

which works pretty okay so don’t hesitate to use it if (tax) things are not clear.

What about AirBnB?

First: What has drive up house prices and rent the most? The lend-for-0%-if-you-are-a-private-bank-money “quantitative easing” (aka printing money) policy of the central banks.

Now this policy had to be reversed (a bit late) to reduce inflation (money printing in cash or digital causes inflation, who would have thought that? X-D)

Imho AirBnB is one of the rare startups that has grown fast fat in wealth and what usually comes along with it: software quality and innovation have gone down ever since (just as M$ they are probably mostly busy celebrating themselves and their almost market monopoly X-D)

But still AirBnB allows humans to get to know each other and (usually in 99.9% of all cases nothing bad happens “Airbnb pays about $50m annually to hosts and guests, which includes damage to property and legal settlements.”) and trust is build and maybe even friendships formed? So society wise it does some good here, if prices are not exaggerated and if damages happen, they should be covered.

“In addition, sales tax (MwSt) is payable in Germany on income in excess of €22,000 per year. For short-term rentals, such as those offered via Airbnb, a reduced tax rate of 7% applies.” (auto translated from: erfolgreicher-vermieten.de)

11 analysts:

“The SES, based at the Karlsruhe-Durlach tax office, has been in existence since 2014. The eleven men and women specialize in analyzing extensive data sets so that they can be specifically forwarded to the locally responsible tax offices for an audit. So far, a total of 20,641 control notifications have been sent out and an additional tax result of more than 69 million euros has been achieved.” (src: lto.de)

it’s getting even weirder: the NSA has XKeyscore where it is enough to spy on people by knowing their e-mail address and the German finance department has XPIDER (Extended Spider)

the AI madness (of course) does not end there: https://phys.org/news/2023-05-ai-legal-systemwe-pay-attention.html

it get’s crazier:

“Upon request, the plaintiff’s attorney even provided several pages of excerpts from the alleged files – all of which, as it turned out, had been invented by the AI.”

auto translated from golem.de src of the src: nytimes.com

why is this tax (in)justice?

Even less analysts work on the still not finished persecution of 130 international banks (JP Morgan, Morgan Stanley, Barclays, HSBC, UBS, BNP Paribas… many more) that engaged in tax fraud known as: Cum-ex that was going on over a decade has cost the German tax payer at least €55 billion.

“Estimates of the cum-ex scandal’s total financial damage to the German state range from €5bn to €55bn.” (theguardian.com) (it is probably way more but who cares right? :D)

If one’s calculations are correct, 69 millions are 0.12545% of 55 billions.

So the Cum-Ex scandal is 797x bigger than what those 11 AirBnB & eBay analysts managed to recover.

99% of those 55 billions will NEVER be recovered, 99% of the bankers involved will never see jail or pay any fines.

This is not only ridiculous double-standard but also a serious (deliberate?) system failure.

With finance ministers and even the current chancellor Scholz pretending to be stupid.

“In 2016, the possibility of recovering CumEx funds amounting to almost 50 million euros from Warburg Bank lapsed” (“timed out” so to speak) (auto translated from: finanzwende.de <- highly recommended read)

PS: abolishing cash will do nothing to prevent those cases as they are already 99% done electronically.

Threaten City of London, Ireland, Luxembourg, Panama and Switzerland and all CumEx involved banks with the cutting of internet access, way more threatening than any other trade embargo or prone-to-fail because of lack of staff investigation.

2016: https://www.dw.com/en/german-fiscal-authorities-investigate-cum-ex-trade-fraud/a-35896489

liked this article?

- only together we can create a truly free world

- plz support dwaves to keep it up & running!

- (yes the info on the internet is (mostly) free but beer is still not free (still have to work on that))

- really really hate advertisement

- contribute: whenever a solution was found, blog about it for others to find!

- talk about, recommend & link to this blog and articles

- thanks to all who contribute!